CTP Insurance: Are you covered?

CTP Insurance: Are you covered?

What is Third Party Car Insurance?

Compulsory Third Party Insurance covers compensation payments made to an individual who has suffered injuries arising from a motor vehicle accident.

Compulsory Third Party (CTP) insurance also covers payments made to individuals (often by-way-of Estate representation) who are killed in a car accident.

However, it doesn’t cover the cost of damaged vehicles or property. There are a set of circumstances and general policies worth considering when evaluating your ability to make a claim using compulsory third-party insurance.

1. Who is protected under CTP insurance?

In Australia, every owner of a motor vehicle must hold compulsory third-party CTP insurance. In Queensland and New South Wales, you must acquire compulsory third-party insurance prior to registering your car.

In contrast, CTP insurance is included in the price of registration in Western Australia, Tasmania, Australian Capital Territory, South Australia, and Victoria.

The compulsory third-party car insurance is attached to the vehicle, as opposed to a driver. Therefore, if the injury of driver B was caused by a car accident that occurred due to the fault, or primary fault, of driver A, then driver B can make a claim to the CTP car insurance company of driver A.

In other words, insurance extends to any driver of the motor vehicle and protects any individual who may be injured following the motor vehicle accident caused primarily by the driver of this vehicle.

CTP insurance also covers any member of the community who may be injured or killed in an accident, such as pedestrians or cyclists.

2. What does CTP insurance cover?

Notably, CTP insurance does not protect any damage caused to your vehicles or property, nor will it cover any issues surrounding the theft of the vehicle.

CTP insurance will also not protect you from liability surrounding damage caused to other people's vehicles or property.

CTP insurance will, however, cover the injured person's damages which can include but are not exclusive of, loss of earnings, medical expenses, and future loss of earnings. CTP insurance can also cover emotional loss such as pain and suffering.

3. Can I claim CTP insurance?

Subject to the accident being of no fault, or minimal fault, to the injured driver or victim, the injured party may be able to procure compensation.

The correct procedure which needs to be carried out in order to facilitate whether a claim can be successful is as follows:

A. Police

Ensure to report the accident to the police and complete any relevant documentation within your State or Territory.

B. Fault

Identifying the vehicle at fault is imperative. If the injured party was the vehicle at fault, claims will become limited. However, if the injured party was not the vehicle at fault, then the procedure is relatively easy from this point onwards.

C. Discover CTP insurer

It is important that you receive the details of the driver at fault CTP insurer so that you can make a claim. In Queensland, the CTP insurer can be identified by completing a registration search of the vehicle at fault.

In other States and Territories, this process may differ. In NSW, for example, you can find the CTP insurer of the vehicle at fault via Service NSW Check registration.

D. Follow the insurer's guidelines

Each insurer will have a separate set (however similar) of guidelines that must be followed accurately and effectively. You may wish to contact our firm in order to ensure this process is completed easily.

E. Lodge the claim.

4. Common circumstances where CTP insurance can be claimed

There are many different circumstances in which CTP insurance claims can be made. The primary element to remember is that the injured or killed claimer must not be at fault, or primary fault, for the incident.

For example, if a driver fails to give way and drives through a pedestrian crossing, injuring a person, then the driver is at fault. The pedestrian can therefore make a claim.

Another common set of instances that allow for CTP insurance claims to be made involves cyclists and motor vehicle accidents. If a cyclist is hit by a vehicle, they may lodge a claim.

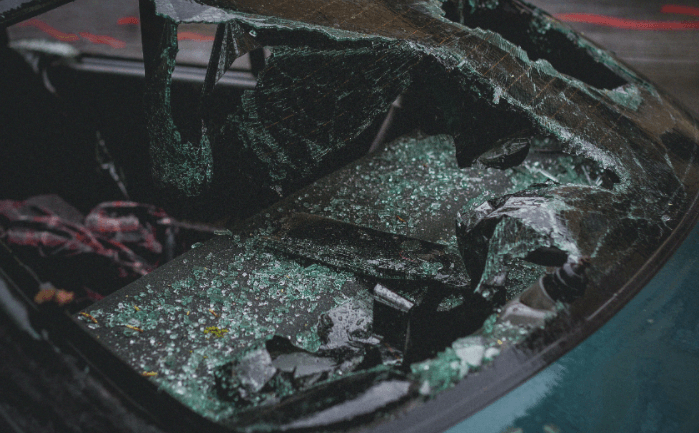

Motor vehicle accident

Also, if a cyclist uses evasive maneuvers for the purpose of navigating around other vehicles that have made a sudden turn and consequently become injured, they may make a claim.

It is also important to remember that passengers traveling in a vehicle that is at fault in an accident are also able to make a claim if they suffer a personal injury caused during the accident.

5. When will I receive payment?

Every CTP claim will be processed at a different rate, however, on average, claims will be resolved within 12-18 months depending on the circumstances of the case.

Significantly, the CTP claim can be prolonged if the driver of the vehicle you have claimed to be at fault denies responsibility for the accident

The insurer denies liability or your injuries are complicated.

6. Why do I need a lawyer?

You will often hear that CTP insurance claims do not require the employment of a solicitor. However, there are many reasons why hiring a solicitor will greatly, and positively, impact your CTP insurance claim process and successful outcome.

For example, at KMB Legal, our lawyers can help you ensure that the forms are completed accurately and within the relevant time period. The investigation process is often taxing, and therefore a solicitor is an ideal person you can hire to help guide you through this process.

Due to our lawyers' expansive experience with CTP insurance claims, they will be able to provide you with estimates that broadly outline how much the CTP insurance and car insurance claim should be worth.

The time limits surrounding CTP insurance claims, car insurance claims, investigation processes, and other administrative work are extensive, and therefore adhering to such time frames can be stressful for an individual.

Here, at KBL Legal, we seek to aid you in this process and reduce the stress as well as time management issues that arise prior to and following the submission of CTP insurance claims.

CTP insurance claims are an integral element of road safety, protection, and allocation of liability in Australia. It is important to feel confident during the process of making a claim.